The Twilight of the BRICs and CTRL-C, CTRL-V Growth

- isometry

- Nov 5, 2015

- 5 min read

It is high time for a relief rally in emerging markets, and we got one. CDS EM spreads properly compressed over the last 30 days or so. Some of the names I watch like Sberbank have performed well.

But fragility lingers. Just a few months ago, a collapse in the price of oil meant that the Russian economy collapsed too. Brazil was the same, looking like a banana republic way short of bananas. China has a debt problem that rivals the worst excesses in modern financial history. As is the rest of the emerging world, India shows an extreme sensitivity to USD-based interest rates and has massive current account risk of capital flight. The fragility speaks to something deeper than a news blip: There is no more growth to be had from massive injections of investment subsidies into bloated manufacturing capacity for these guys.

At best, the BRICs are in a middle-income trap, sort of a game-changing transition which more often than not ends with a country hurtling back into poverty. It escape the trap and emerge as a high-income consumer-driven society, it will require a thorough rewiring of their societies. Advanced development seems impossible in semi-totalitarian societies that do not reward innovators with returns on their ingenuity.

So the challenges for BRICs are significant. Think about your smart phone. Apple has the high-end product that just simply works and just simply keeps stealing market share from the leader, Samsung. There are also over a dozen smaller makers of low-end, cheap-and-functional cell phones, also cutting into Samsung’s market share. Samsung is the mid-market producer, neither incredibly cheap nor bad. And it is the target because its big share of the market makes it difficult to move. It can’t easily build a smart phone than what Apple’s, and it can’t be all “visionary” and start from scratch, because the risk of losing current customers is huge. At the same time, it can’t continue to produce phones that lose market share because customers look for cheaper but essentially equivalent smart phones or are willing to pay extra for a top-shelf product. Samsung is like the BRICs, facing in the middle income trap.

BRICs cannot offer the intensive growth that generates constant returns to scale ( what I call ctrl-C, ctrl-V growth) they have accomplished in the past; the ROI is not economic in a deleveraging world that just doesn’t want mass quantities of cheap stuff when it is paying down debt. BRICs cannot offer extensive, increasing returns to scale, consumer-driven growth without first the dismantling the authoritarian macroeconomic policies that have controlled their societies over the last couple of decades. It will take years to see any ROI on this sort of reconfiguration.

If you think this is a challenge, imagine how bad it is for lower income “frontier” markets. They are the smaller cell phone makers trying to enter a market and must offer a price point that gives them razor thin margins. For every one that makes it to the next level, there are nine that go BK in short order. Start-up smart phone makers are like frontier markets. Capital flows come and go like fads, more often than not leaving a wash-out. But for those that make it, the growth is phenomenal.

So are frontier markets worth a look given the need to look beyond the BRICs? Frontier markets potentially offer the kind of cheap growth investors have come to expect, but that growth doesn’t necessarily mean returns. It is at least worth exploring.

Anything is worth a gamble, appropriately sized. But taking ownership in a frontier market companies

without boots on the ground and without proper tribute paid for legal protection is likely to be throwing away money. The stock market is arguably an insiders’ game everywhere. In a frontier market, it is absolutely the case. The alternative, very risky bet is on credit. Credit is everywhere way more asymmetric than equities. This means that you make some money for a long time and rarely lose a lot. In frontier markets, the key is to understand the meaning of “rarely”. Here’s the vig: whether frontier market debt is viable in spite of a collapse in commodity exports revenues. If so, then meaningful yields turn into nice

total returns over the long term. If not, well you know the end of that story.

Frontier markets have issued debt just like the BRICs—not in degree but in kind they are the same—and are thus very sensitive to USD based rates and behave just like a BRIC.

But they offer something that the BRICs don’t: cheap and formulaic intensive growth is impossible in the BRICs anymore. Frontier markets generally have more favorable demographics, meaning plenty of babies being born and a not-too aged population. This gives you a standing reserve of labor that can be connected to capital to generate ctrl-c, ctrl-v growth. Secondly, some frontier markets have a BRICish general openness to investment, technology and the efficiencies that they afford. Finally, you need a strong, most likely authoritarian government committed to the rule of law and shepherding in reforms that improve the economic fundamentals necessary for ctrl-c, ctrl-v growth. This last point may be puzzling, but generally speaking markets need to be embedded in a stable social framework. Capital definitely won’t stay long without this condition.

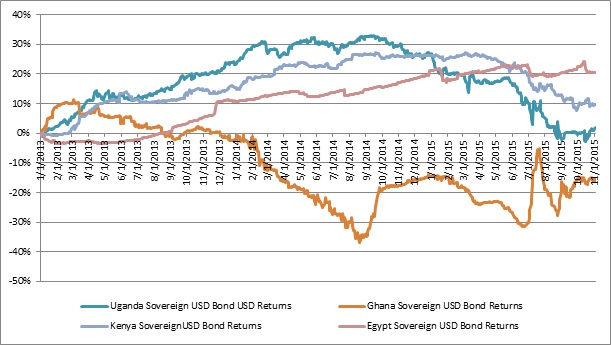

Here’s a look at the returns to African sovereign credits, using 201301 as the base. There is no point getting all quantish about these bonds. They are illiquid, even proudly so. For the lowest tier of frontier markets, the gaze needs to be on total return. Only for names with some bond liquidity—and I mean liquidity in the most generous sense—is it meaningful to look on a yield basis.

The market has not been kind to Ghana, but in all fairness, there are only four sovereign bonds floated by this country and all are long dated. One of them was just issued and way oversubscribed earlier this fall. Ghana is tapping capital markets fine, but on a return basis all the issuance causes intense indigestion in a thin market. There are sales restrictions on Ghana bonds as well, making liquidity and thus returns really volatile. Egypt is an outperformer among these names, posting a 20% total return. A big chunk of this return is just price appreciation that came after the Muslim Brotherhood nightmare came and went. Egypt is no stranger to the bond market at all, but even Egypt has choppy looking total return. It is rare for a sovereign bond to look like this. Pitty the geopolitics, but that is a major hassle one must accept when going long a frontier bond.

Now these aren’t by any means market darlings. Bonds in frontier markets with the same favorable demographics, better institutions (debatable), and some bond liquidity do exist. While no market darlings, Nigeria and Philippine USD bonds are more interesting plays on the vig.

Nigeria bond vol dwarfs that of the Philippines, as does the yield level. It’s hard to break yield at 12% short of default. Seen rescaled, there is still plenty of volatility in Philippines bonds compared to the typical bond you see running around.

A crucial point: The entire credit market has started to deteriorate as the data indicates a global economic slowdown. This is compounded by China’s drastic rebalancing and related deflationary pressures. After being the dominant global growth engine for nearly a decade, China is now the global Achilles’ heel.

This is probably a bit too simplistic, but the rest of the BRICs with the exception of India, the BRs are basically leveraged plays on Chinese intensive ctrl-c, ctrl-v growth. They will need to find new markets and new configurations to avoid becoming frontier markets.

Whether the Chinese economic news-flow spells a full-on financial implosion or it spells a short, necessary, non-straight-line transition to a new state of economic being, China has a massive interlocking public-private debt pile accumulated over decades of centrally planned reallocation of capital. Default will bring the kind of rational discipline that depoliticizes a thoroughly centrally planned society.

Comments