The Heta Asset Non-Event

Earlier this month, the government of Austria announced that Heta Asset Resolution, the “bad bank” that resulted from the restructuring...

The Shrinkage of the Shrew

Even in the darkest and most fearful times when some are huddled up in a guano-stained bunker, there is always money sloshing around. At...

Distinguishing between a Sell-Off and a Tail Risk Event

In a prior post, I mentioned the growing divergence between HY and CDS spreads. I got really nervous about something big coming when...

How to Invest in Korean Unification

South Korean PMI shows activity picking up last month at the fastest rate since early 2013. This is some welcome news for the global...

Widowmaker Autopsy Report

Since January spreads on generic Japan 5Y CDS have cratered, outperforming corresponding Japan IG credit. Not that Japan IG has been a...

Raising Rates will be Curtains for Independent Central Banking

Independent central banking—meaning central banking presumably free of political influence—is something of a misnomer. Political factors...

A Big Kahuna Shaping Up

There is an unmistakable rhythm to the universe, played over and over again until time burns beneath the unlaboring stars. In 1997, the...

Investing and State-Sponsored Capitalism

We live in an age of state-sponsored capitalism. The massive capital flows into emerging markets in this age rest on very uncertain...

The Raw Power of the Dragh

Forget the “Bernank”. The “Dragh” is a true force of nature. To ask monetary policy to cure all ills—from labor markets to animal...

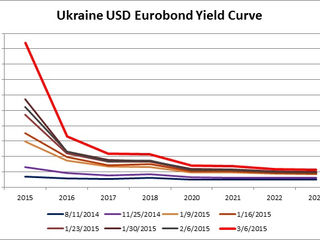

Ukraine Update: I Stand in Awe at the Apathy

Posterity may thank me for keeping a running tab on Ukraine. It is a classic case of utter implosion. Finance does not like nor follow...